Turkish Citizenship

Residency in Turkey is not required to obtain Turkish citizenship through property investment.

It is now possible to obtain a Turkish identity and passports through the Turkish embassy in the country of the investor.

Turkish citizenship by investment programs do not require that the foreign investor give up their nationality upon obtaining Turkish citizenship.

More than one investor can obtain Turkish citizenship through partnership in purchasing a property, provided that the value of one’s share exceeds $ 250,000.

The investor must submit an application that contains all the required documents to the concerned party, as these requests are studied by more than one party, in order for the application to obtain Turkish citizenship to be approved.

Property Investment

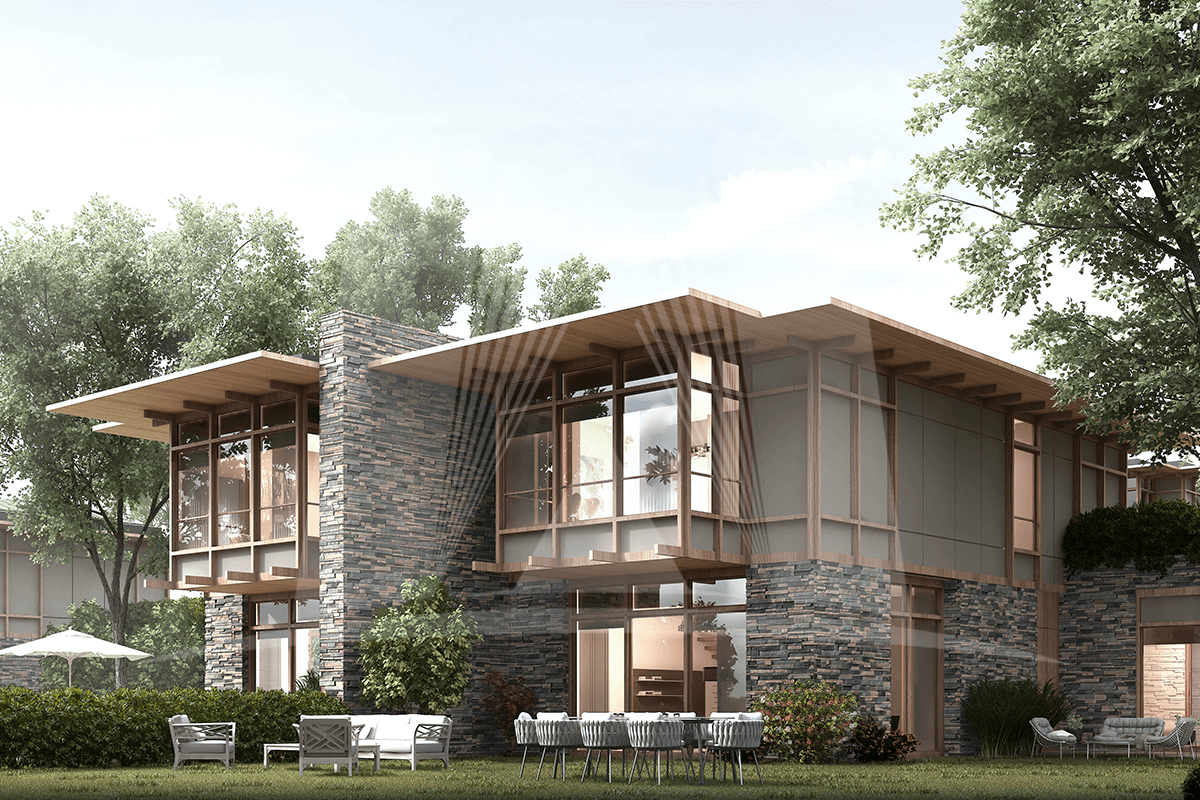

It is known that properties that are still under construction provide a fast and high return on investment when resold, while ready projects provide the opportunity to benefit from the rental return immediately.

Real estate investment areas in Istanbul vary and are distributed in different regions such as Basin Express, Kagithane, Sisli, Esenyurt, and others.

Some projects in Istanbul offer special offers to foreign investors that provide them with a guaranteed return when reselling the property, or a guaranteed return through renting out the property. These details, percentages and prices are mentioned in the sales contracts.

Real estate investment in Turkey is profitable if the decision is made based on real and correct information and data that contribute to taking the right decision at the right time and place

The foreign investor gets many facilities such as real estate residence, high return on investment, both when reselling or when renting out the property. If the real estate investment matches the conditions for obtaining citizenship, the foreign investor and his family members can become Turkish citizens.

property tax in Turkey

Real estate taxes in Turkey are divided into two parts:

One-time taxes such as title deed tax, value-added tax, in addition to some other fees.

Taxes that are paid annually, include municipality tax and earthquake insurance tax.

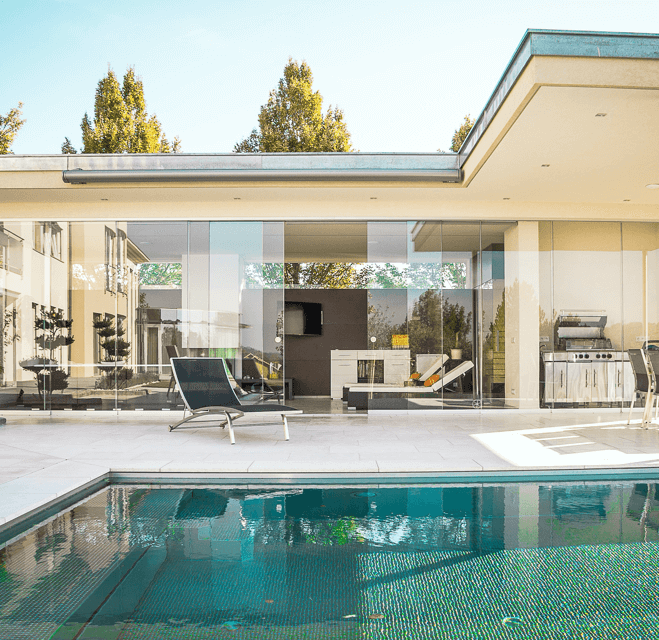

The proceeds are the amounts that are paid monthly by the owners of the apartments in the residential complex in exchange for the fees for maintenance and management of the complex and for the use of the services in it, such as swimming pools, gyms, and others.

This tax is paid in the municipalities to which the property belongs, it differs in amount from one year to another.

It is calculated according to the property size, location and other criteria.

To obtain exemption from paying value-added tax in Turkey, which value ranges between 1% – 18% of the property value, the following conditions must be adhered to:

– That the property is a residential or commercial real estate, and it is not possible to obtain an exemption from paying the value-added tax when purchasing a land in Turkey.

– That the property is sold for the first time and that it is a new building or property.

– That the buyer does not have a residency permit in Turkey.

– That the price of the property is paid in foreign currency.

– the property is not to be sold for one year from the date of its purchase.

This tax exemption is valid for one time and one property only.

Real estate residence in Turkey

It is the residency permit that the foreign real estate owner, husband or wife, and children under 18 get after buying a property in Turkey.

Real estate residency is granted for a period of one or two years and is renewable.

– The real estate residence permit allows the holder to enter Turkey without applying for a visa.

– Allows you to apply for a driver’s license.

– It also allows you to open a bank account in Turkey to send and receive money with ease.

– this residency permit allows you to study in Turkish universities and schools.

– Title deed (Tapu)

– A family statement translated into the Turkish language and certified by the Turkish embassy in the home country.

– Health insurance obtained in Turkey for all family members.

– A passport that is valid for at least 6 months.

– Real estate insurance policy against earthquakes.

The property value is not related to the conditions for obtaining real estate residency in Turkey, as it can be obtained in exchange for the purchase of any residential property.

Syrians are not entitled to direct ownership in Turkey, but they can buy a property by establishing a company and registering the property under the name of this company. Consequently, a holder of Syrian nationality is not entitled to obtain real estate residency permit.