The Turkish government issued a decision to reduce value-added tax on goods and food products to reduce the impact of inflation and the increase in prices, so the tax became at 1% after it was 8%, and after this decision, food stores began to reduce the prices of food products that they sell to citizens.

The Turkish government has begun studying the decision to also reduce the value-added tax on real estate, which amounts to 18% on real estate with an area of more than 150 square meters.

The Revenue Department held a meeting for representatives of the chambers and sectors, which resulted in the decision to simplify the value-added tax. This decision aims to several things, the most important of which are: ease of business conduct, increasing the vitality and competitiveness of sectors, improving the investment environment, and reducing the informal economy.

Knowing that a tax of 8% is imposed on both the health and education sector.

As for the real estate sector, different rates of value-added tax are imposed on it. A tax of 18% is imposed on real estate with an area of more than 150 square meters.

According to the new law, it is expected that the tax rate on real estate with an area of less than 150 square meters will be only 1%, and it will be reduced to 8% on real estate with an area of more than 150 square meters.

Value-added tax on real estate for foreign property owners in Turkey

Foreign investments in Turkey have flourished in the past years, specifically in the last three years, and Arab investors have had the largest share in these investments

As for the value-added tax for foreign investors in Turkey, it is known that the Turkish government exempts them from this tax to encourage foreign investments in the country, knowing that this exemption is only made according to certain conditions, which are:

- The foreign person does not obtain any prior residence in Turkey or is not taxed in the state of Turkey.

- Proof that the funds were transferred into Turkey through a bank receipt or a permit to enter the funds from the border entrances.

- The property shall not be sold for a full year from the date of its purchase.

- The purchased property must be among newly constructed or sold properties for the first time

- That the purchased property is a residence or a work office, this exemption does not apply when buying land in Turkey.

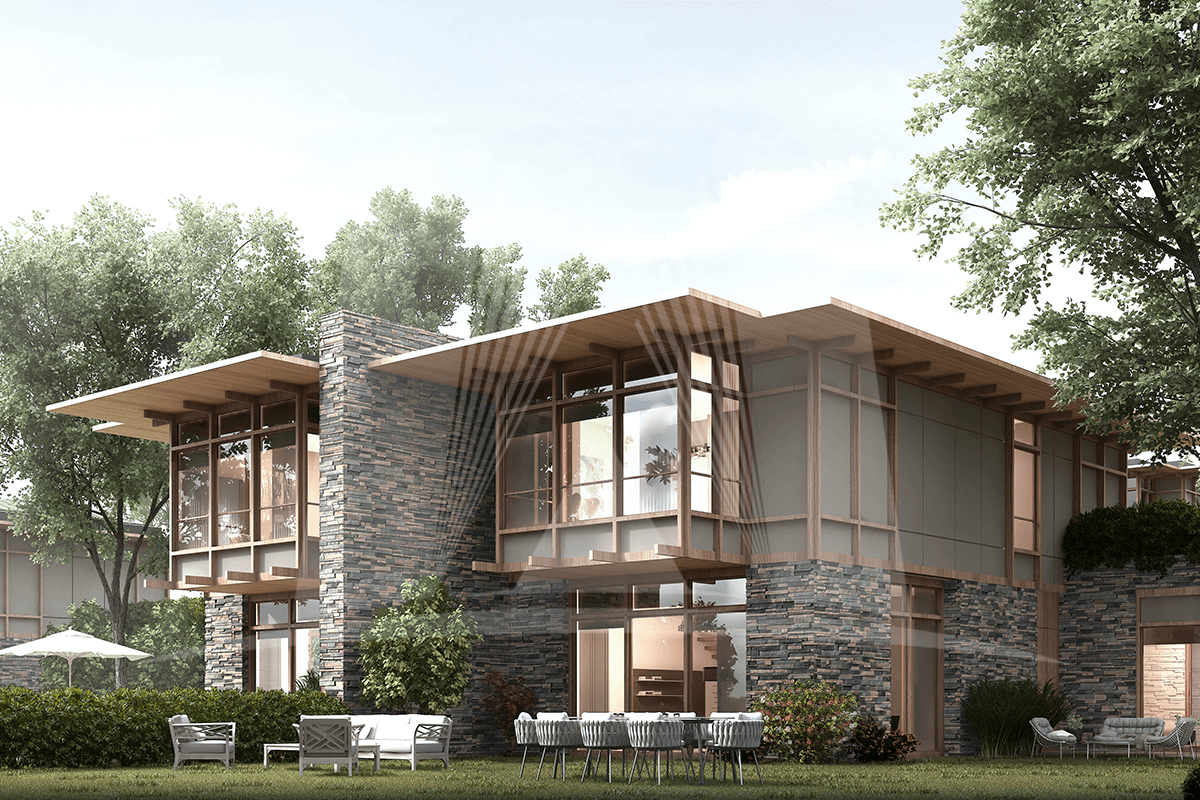

The best property investment areas in Turkey

Istanbul ranks first in Turkey in terms of the cities that sell the most real estate, and thus foreign investors benefit from the tax exemption granted by the Turkish authorities.

Following the previously mentioned tax exemption conditions, it is recommended to buy modern properties or real estate under construction to take advantage of this exemption, and among the best areas that we advise you to invest in, Maximum Property provides you with many options in areas like Beylikdüzü, Basaksehir, Buyukcekmece, Basin Express, Bahcesehir, and other areas that have become the focus of attention for many real estate investors due to the rapid development witnessed by the Turkish government in terms of rehabilitating them to become distinctive residential areas, in addition to the location of these strategic areas which is close to vital facilities such as hospitals, schools, and major highways.

Contact us for more details about our projects.